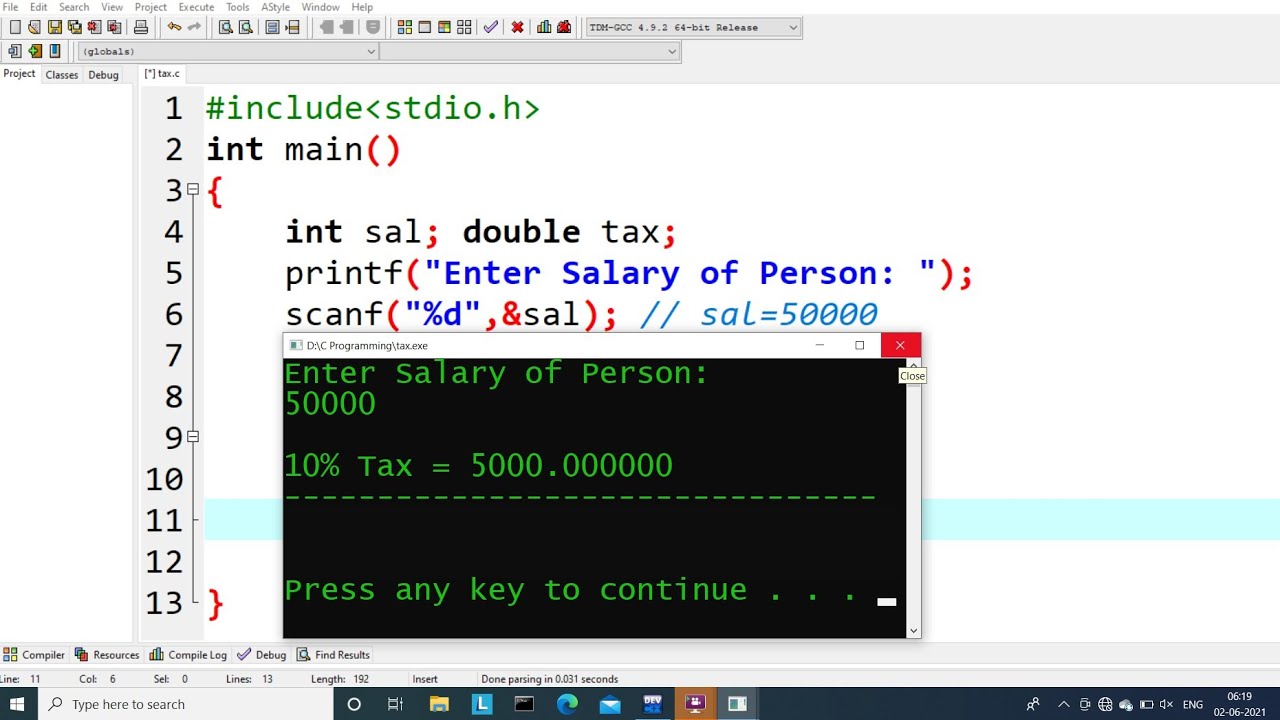

C Program to Calculate Income Tax

Annual Taxable Income Rate. We all go to restaurants frequently and eat.

C Program To Calculate Tax Given The Following Conditions Computer Notes

In Part I you list all the income from your business and calculate your gross income.

. For more detail regarding Corporate Income Tax calculation in. In Part III you calculate your cost of goods sold if applicable to your business. In this c program we enter a number and calculate tax with the given following conditions.

With multiple items in a. To find out if you qualify for these services and to find a tax clinic near you go to Free tax clinics or call the CRA. In Part II you add up all of your expenses and subtract them from gross income to determine your net profit or net loss.

Income tax are included with the T1 Income Tax ReturnEven if you dont owe income tax you can file an income tax return to claim a refund credits or benefits. Today let us write a code to calculate the restaurant bill. Java code to calcuate the resturant bill the following program is pretty simple one along with sample outputs.

TS Teachers Income Tax Software for Teachers Income tax Slab rates Employees Income Tax Calculation Financial year 2022-23 Income Tax Assessment year 2023-2024 80c Saving limit FY 2022-23 AY 2023-24. Forms to calculate your BC. Check the Box on line 28 and attach a completed form FTB 5806 only if Exception B tax on annual income or Exception C tax on annualized seasonal income is used in computing the penalty.

If taxable income is in the range 300001-500000 then charge 20 tax. Java program to calculate Electricity billIf you wondering on how to calculate Electricity bill by writing the Java program there you go. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

Updated AP Teachers Income Tax Software 2023. The filing of a composite tax return and composite payments of estimated taxes will satisfy the obligation as to any Massachusetts-source income derived from the pass-through entity of each qualified electing non-resident to file a tax return and to make estimated tax payments under MGL. Line 29 Total Amount Due.

62C 6 and MGL. See General Information K Payment of Tax. If taxable income is in the range 150001-300000 then charge 10 tax 3.

If you have an individual income of 100001 and above or a combined household. You can apply as an individual or as a household. If income is less thn 150000 then no tax 2.

We have choosen the famous south indian food to create the following program. Income Tax Software 2022-23 TS AP Teachers IT Calculator with PRC Arrears Form 10E Download. If you have a modest income and a simple tax situation volunteers can complete your tax return for free through the Community Volunteer Income Tax Program or in Quebec the Income Tax Assistance Volunteer Program.

This is the figure you report on your income tax return. Resident with a valid BC. The next amount over Rp.

In this tutorial we can learn C program to calculate tax. Here we share the list of code with sample outputs in five different ways using static values using function or method using command line arguments do while for loop user define method along with sample outputs for each program. Income taxes are administered by the Canada Revenue Agency CRA.

Organizations required to pay by EFT must remit the amount due by EFT. The rebate amount is based on you or your households total gross annual income and the type of vehicle youre buying. For income tax years commencing on or after January 1 2022 section 39-22-3041b CRS prescribes specific rules for determining the federal taxable income of a C corporation that is not incorporated in the United States or included in a consolidated.

To apply for a rebate you must be a BC.

C Program To Calculate Tax On A Salary Learn Coding Youtube

Income Tax Calculator Python Income Tax Income Tax

Comments

Post a Comment